Preparing for your first fundraising round?

The process can feel overwhelming. Which numbers to highlight, which story to tell, and how to convince the investor that your idea is worth their time and money?

Everything may seem intimidating. But, fret not. Investors look for some core things that make or break the deal. We’ve done all the heavy lifting and brought you some pointers you must keep in mind while framing your early stage fundraising pitch.

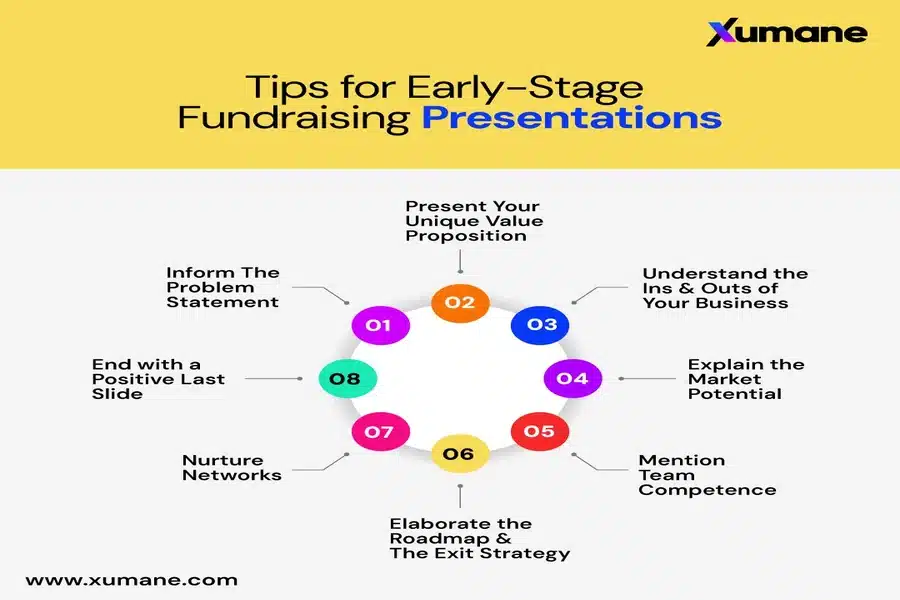

So whether you’re creating your first pitch deck or polishing it before an important investor meeting, check up on these 8 things before finalizing your deck.

Here we go!

Tips for Early-Stage Fundraising Presentations

1. Inform The Problem Statement

A strong presentation hits you right at the beginning. So, when you sit down with the investor, you should have a clear problem statement mentioned and explained.

As Jurgen Appelo, author of Startup, Scaleup, Screwup, says:

‘[Founders] must be able to explain, to yourself, to customers, and to investors, which problem you will solve or which opportunity you will address. What are people’s top frustrations or aspirations? What is their job to be done, and what is the major pain or irresistible gain, and why are current solutions inadequate?’

For example, a stat like “60% of mid-market businesses report supply-chain disruptions as a primary growth barrier,” is bound to catch the attention of the investors you’re pitching to.

Ensure that you back your problem statement with data. There’s a report that says ‘investors and consultants emphasize empathy (33%), data (21%), and succinct, relatable storytelling as top elements’ while contemplating their investment in a business.

2. Present Your Unique Value Proposition

Once you’ve conveyed the problem, you need to present your Unique Value Proposition (UVP).

What is the solution that you’re presenting? How is it unique to what other market leaders in your space are offering? How are you better than your competitors?

For example, Paper Boat’s UVP is nostalgia, rightly reflected in their tagline, “Drinks and Memories”, Mamaearth’s UVP is safe and toxin-free personal products, well reflected in their tagline “Goodness Inside.”

Remember, a strong UVP is honest, relevant, and highlights the differentiating factor of your brand.

3. Understand the Ins & Outs of Your Business

What do you think is the most impressive thing about a pitch?

It’s when a founder knows their numbers inside out. Remember, clarity in thought brings clarity in expression.

So, apart from presenting data, ensure that you’re fluent in revenue numbers and the unit economics of your business. Highlight month-on-month revenue and cost-per acquisition improvements. Having core numbers on your tips makes them feel safer with their money in your business.

And yes, always carry backup files with deeper details about the numbers you’re referring to.

4. Explain the Market Potential

- If you’ve seen Shark Tank, you know the investors’ favorite question – How big is the market size?

- No matter how good your product is, if there’s no market for it, it’s going to remain a tough sell.

- You need to highlight that your offering has a big and expanding market size. So, define your target niche (backed with credible data).

- Plus, show proof of demand and interest in your offering – paying customers, signed pilots, revenue growth, and early partnerships. You basically need to show potential of scalability in the market.

5. Mention Team Competence

Even the best idea falls flat without the right team members to execute it. So highlight your key team members, their experience, skills, domain or technical expertise.

You can include their key achievements. It’s great to include their pictures – it humanizes them!

Oh, and don’t overlook your advisors or board members. This further helps boost your business’ credibility.

When your investors believe in your team’s capabilities, they’re more inclined to bet on the business idea.

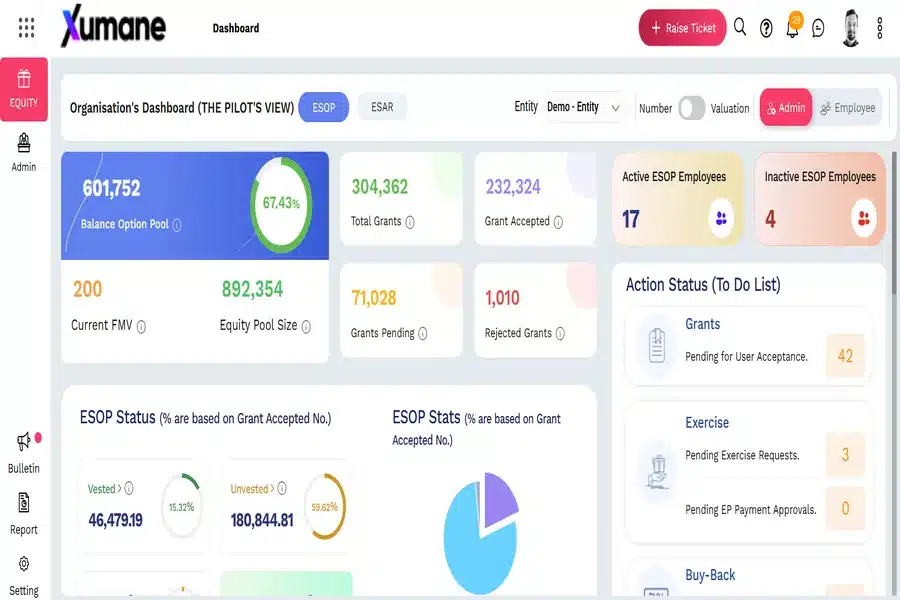

Tip: As your business grows, ESOPs come into the picture. You may decide to offer an Employee Stock Option Plan (ESOPs) to your employees or to your advisors.

It’s best to adopt a good ESOP management tool like Xumane.

What that does is that it helps you stay transparent right from the start about your equity structure and helps give a clear idea to the investor of what the future equity distribution is going to look like.

6. Elaborate the Roadmap & The Exit Strategy

Now comes the real deal. How do we reach where we aim to be?

You need to show investors what is the detailed plan of reaching a stage where the investor is able to make a profitable exit.

How do you intend to use their capital? How will that capital help in attaining growth?

Present a clear roadmap. It’s best to do this with the help of milestones – product launches, user acquisition goals, which are tied to timelines.

Depending on what your ask is, tell the investor how you intend to use the money you’re requesting. Example:

- 40% Infrastructure

- 20% Research & Development

- 20% Market Expansion

- 10% Hiring

This goes on to show the investor that you have a roadmap ready to execute with an end goal in mind. Also, this helps them picture an exit strategy for themselves, whether via an acquisition or an IPO.

7. Nurture Networks

Fundraising is a lot about trust. It’s the trust in a person’s ability to scale the business. It’s the trust in the ability of the product or service to dominate the market.

In fact, the strongest rounds often come from those who’ve been following your journey over time.

Your fundraising journey starts quite before you actually initiate fundraising. Attend industry events. Try to be part of communities with influential people or people who invest in other businesses. Build your rapport with them, seek informal advice, seek feedback and engage well.

By the time you’re up for funding, you will already have some warm connections who understand your vision and credibility.

8. End with a Positive Last Slide

In the last slide, you intend to summarize pitch and inspire the investor.

Recap the problem statement, the core solution, and the market opportunity.

“We’re seeking $500K to scale operations, projecting a 5x return within 24 months.”

This leaves the investor with a clear ask and a strong lasting impression.

That’s all! I’m sure this list will guide you through various fundraising stages for your startup. If there’s one takeaway, it’s this – yes, numbers are important, but even more important are relationships. Keep networking, build trust, and then let your pitch deck do the talking! Need expert support in your fundraising journey? Connect with Xumane today or Contact Us to get started.

FAQs:

- What are the main fundraising stages for startups?

The main fundraising stages for startups include pre-seed, seed, Series A, Series B, and so on. At each stage, founders need to refine their pitch and align it with what the investor is looking for at that particular stage.

- How should I prepare for early stage fundraising presentations?

To prepare for early stage fundraising, you must focus on defining the problem, highlighting your value proposition, conveying team potential and presenting a clear roadmap.

- What do investors look for during the first fundraising stages?

During the first fundraising stages, investors look for clear founder vision, a strong team, market potential and actionable roadmap.

- What are the most common mistakes to avoid during early stage fundraising?

One of the major mistakes in early stage fundraising is asking for an unrealistic funding amount. Ensure that you are clear about your financial numbers, your roadmap, what milestones you aim to achieve along the way and when. Having the numbers and timelines sorted will help you avoid any mistakes.